ESG, Sustainable Finance and the Funding for the Green Transition

Discover concepts and tools that can be used in financial strategies and investments that create value for society

Modalidade Presencial

The green transition poses a significant challenge in today’s world. Uncertainties of environmental regulations and the growing attention to accountability and transparency regarding organizations ́ efforts on environmental, social, and economic (ESG) performance have required an expansion of business relationships beyond those conventional ones with stockholders.

In this context, decision-makers must understand how to create or destroy value for various stakeholders based on environmental and social challenges. There is a need to redesign the way of doing business, invest in new technologies and infrastructure, and divest stranded assets.

Firm valuation is increasingly reflecting both the positive and negative impacts of sustainability practices. The financial market plays a pivotal role in funding environmental and social projects and advancing the corporate social responsibility agenda. It will be necessary to design creative solutions to finance many of the required innovations and actions.

This course focuses on identifying risks and opportunities for creating shared value and promotes reflection about concepts and tools that can be used in financial strategies and investments that create value for society.

It is part of the MBA International Week, which is a short-term program designed to provide students with a unique opportunity to expand their knowledge and skills in various topics of the business world in classes with international and Insper professors.

Investimento

Valor integral R$ 4.889,00

Valor para matrícula antecipada (10% de desconto até 25 dias antes do início do curso)R$ 4.400,10

Valor para Alumni Insper (25% de desconto)R$ 3.666,75

Formas de pagamento

- À vista no boleto ou cartão de crédito

- Ou parcele em até 10X sem juros no cartão de crédito

Por que fazer o curso?

Identify relevant socioeconomic and environmental problems in organizational contexts and describe their relation to business performance;

Understand the drivers and payoffs of sustainability strategies;

Estimate the impact of sustainable practices on the firm value;

Recognize the importance of open innovation for corporate sustainability;

Discuss the private equity governance model and its role on improving ESG performance;

Identify investment strategies and financial tools to fund sustainability projects.

O que você precisa saber

Perfil

The program is aimed at senior professionals, executives, entrepreneurs, consultants, and decision-makers with over 5 years of professional experience, experience in management, and varied backgrounds in different areas and sectors of the economy, who are interested in corporate sustainability.

Pré-requisitos

Completed higher education degree. Classes will be conducted in English without simultaneous translation. Although no proficiency test is required, we recommend B2 level to fully engage with the program.

O que você vai aprender

Sustainability and ESG – why does context matters?

- Great challenges: climate urgency, planetary boundaries, social inequality;

- Coordinated initiatives for a more sustainable world;

- Long-term social and environmental risks and fiduciary duty of financial players;

- Challenges and opportunities.

Materiality, sustainable strategy and ESG reporting

- Materiality and sustainable strategies;

- Plan of actions and impact;

- Different report standards;

- ESG scores.

Sustainability and firm value – how to incorporate ESG in firm valuation and financial ratios?

- Shareholder versus Stakeholder value creation;

- Incorporation of ESG in the value drivers and cash flows;

- Impact of ESG performance on the cost of capital.

What is the role of technology and open innovation in sustainability?

- Circular economy and the importance of technology for sustainability;

- The entrepreneurial ecosystem;

- Open innovation and sustainability.

The private equity governance model for funding and improving ESG performance

- The private equity model;

- Corporate engagement in public companies.

Investment strategies and financial tools to fund sustainability projects

- Debt instruments to finance green transition;

- Blended finance and catalytic capital;

- Carbon credit.

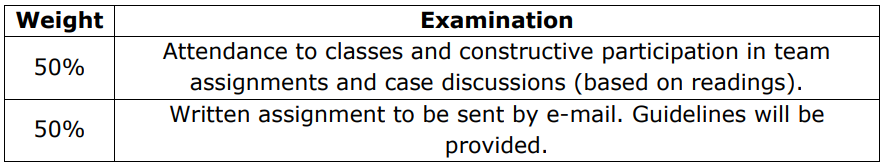

Course evaluation:

Corpo Docente

A maioria dos nossos professores é de mestres e doutores oriundos de renomadas escolas nacionais e internacionais e/ou executivos com extensa experiência profissional e prática.

Andrea Minardi

Senior Research Fellow Professor at Insper Board Member of the Climate Smart Institute and Insper Angel Association Associate Editor of Finance and Accounting Review and of Brazilian Finance Review She was undergraduate academic Dean of Insper, Director of the Brazilian Finance Society, and member of the Executive Committee of BALAs (Business Association of Latin American Studies). She teaches and does research in Investments and Corporate Finance. Since 2015 she has focused her academic activities on alternative assets and entrepreneurial finance, and more recently, also on sustainable finance. She is the author of the book “Teoria de Opções Aplicada a Projetos de Investimentos” and many published articles and book chapters. She has a bachelor’s degree in Production Engineering from the Polytechnique School of the University of Sao Paulo and a master’s and Ph.D. in Business Administration from Fundacao Getulio Vargas in Sao Paulo. She was a visiting Ph.D. student at the University of Texas at Austin.

Andrea Minardi

Senior Research Fellow Professor at Insper Board Member of the Climate Smart Institute and Insper Angel Association Associate Editor of Finance and Accounting Review and of Brazilian Finance Review She was undergraduate academic Dean of Insper, Director of the Brazilian Finance Society, and member of the Executive Committee of BALAs (Business Association of Latin American Studies). She teaches and does research in Investments and Corporate Finance. Since 2015 she has focused her academic activities on alternative assets and entrepreneurial finance, and more recently, also on sustainable finance. She is the author of the book “Teoria de Opções Aplicada a Projetos de Investimentos” and many published articles and book chapters. She has a bachelor’s degree in Production Engineering from the Polytechnique School of the University of Sao Paulo and a master’s and Ph.D. in Business Administration from Fundacao Getulio Vargas in Sao Paulo. She was a visiting Ph.D. student at the University of Texas at Austin.

Processo Seletivo

Conheça as etapas para ingressar no curso:

01.

Preencha o formulário de inscrição

02.

Análise do seu perfil

03.

Aprovação

04.

Matrícula Digital

Programas específicos da área de Internacional, passam pela etapa da entrevista anterior a aprovação.